Why Play the Lottery When You Can Live a Better Life?

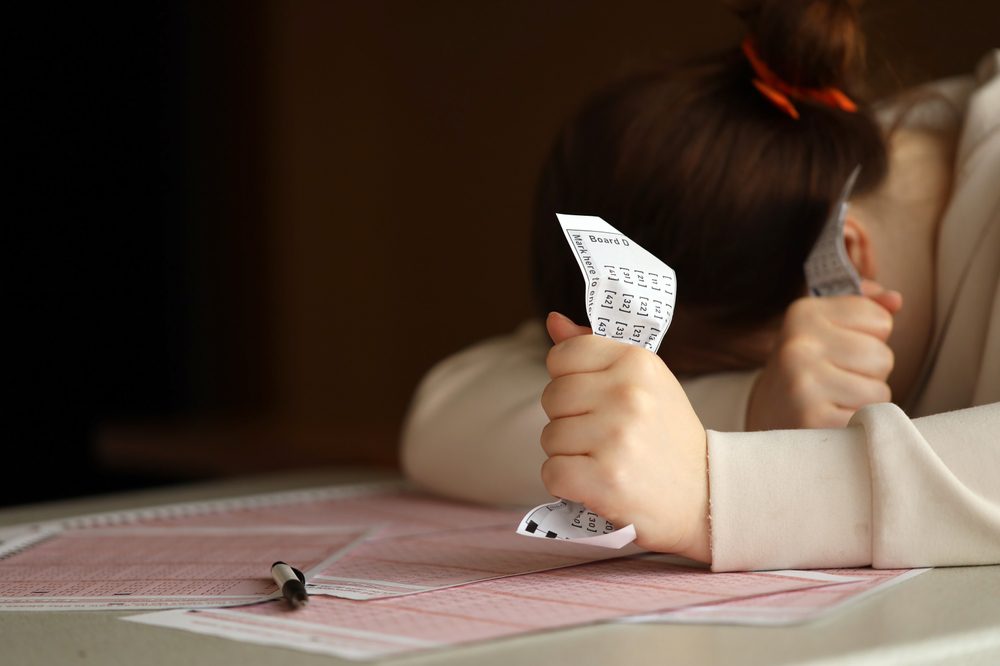

The temptation of playing the lottery has a lot of power – especially now that the Mega Millions jackpot is over $1 billion for the fourth time in history. In theory, the principle is very simple: you pony up a couple of bucks for a ticket while you’re getting your coffee in the morning, and a few days later, all your dreams suddenly come true.

The line of thinking lures Americans into spending more money on lottery tickets than books, movies, video games, sporting events, and even music altogether. We drop over $71 billion a year on the impossible dream, with just a little slip of paper.

For everyone who plays, however, the dream will never come to reality, and for the tiny minority who will manage to beat the odds, the dream will turn out to be nothing but a nightmare. Here are a couple of reasons why you shouldn’t play the lottery ever again:

You’re positively not going to win

The chances of winning the Mega Millions grand prize are 1 in 302,575,350. CNBC even provided some context for the impossible-to-grasp number. While it’s almost certain that you won’t die from a shark attack, the odds of that happening are even more reasonable, at 1 in 3.7 million.

The chances of dying in an asteroid strike are 1 in 1.9 million, which still seems like a guarantee, rather than winning the lottery. If any of these situations had 1 in 300 million odd success, it would be, without doubt, seen as a lost cause. Then our question is: why would you want to play a game that will give you lower chances of winning than you getting hit by an asteroid?

It’s nothing but a tax

From the state’s point of view, the best tax is the one that doesn’t have to be coerced out of the person who pays it. Since players lose an average of 47 cents for every single dollar they spend on lottery, the system is serving as an implicit tax, of about 38%. Even more, many states will earn more from lotteries than they do from corporate tax.

It ruined many lives and relationships

Time is one of the many publications to report on the famous lottery curse. The unexpected arrival of massive amounts of money causes gigantic upheaval in the life of any person. Lottery players are instantly thinking about cars, boats, travel, and even the freedom that a lucky ticket might bring.

They rarely consider the fact that if an actual win comes on the horizon, everyone they have ever known will start seeing them more as a wallet than a relative/friend/acquaintance, for the rest of their lives.

Not to mention all the jealousy, greed, and resentment that the winner will have to face from others, as these are side effects of winning lottery tickets. Winning such a prize can lead to isolation, paranoia, divorce, and even depression, making the winner just a target for violence or suicidal thoughts.

Winning will paint a bullseye on your back

If by any chance, you win a huge prize, and you’re living in a state that obliges public disclosure (or simply if you’re revealed as a winner), you should prepare yourself for a ton of unwanted attention. You will become one of the world’s biggest targets for scam artists, fraudsters, thieves, and even blackmailers.

Even if you win, you will still lose

Almost ALL big lottery winners have this one thing in common: they will likely declare bankruptcy within three to five years from the moment they cash in that ticket. Big lottery winners are more likely to spend everything, go broke, and even end up worse off than they were before winning anything.

One of the main reasons relies on a certain sense of entitlement that these friends and family start to feel. Plus, many hangers-on start to see the prize as bottomless, so they start to bleed the winner of money as much as possible, which causes a lot of emotional distress along the way.

The advertising is intentionally misleading

State lotteries still have the luxury of being exempt from federal “truth in advertising” laws. This means that advertisers can lie to you that you’d only need a ticket, a dream, and probably some good vibes, to win everything. What makes things even worse is that they can also downplay the odds and risks.

It preys on the poor

According to research conducted by the Journal on Gambling Studies, the wide majority of tickets are sold to low-income Americans in some poor neighborhoods. Poor people will spend way more money on lottery tickets than the general population, even if they can least afford to throw their money away.

Why is that? Because that’s just the effects of lottery-related advertising, that’s way more focused on poor people. Plus, isn’t this the place where the dream can be sold more aggressively?

The poor have something to lose even if they win

A widely disproportionate number of lottery winners need state assistance. This can only mean that they are buying lottery tickets with taxpayer-funded money, which was supposed to be used to help with other necessities. The state doesn’t forbid this activity.

Even more, it will encourage you to do it, through all the advertising strategically placed in places where people get their public assistance. However, in a final act of retribution against the poor ones, lots of states, like New York, confiscate these prizes from anyone who gets assistance, if they do win.

The majority of profits don’t even benefit education

The thing with the lottery is that even when you lose, the kids win every time you bought a ticket, which can only benefit public education. But that’s just a made-up story! First, the lion’s share of all the profits will go to funding payouts, and the other chunk is dumped into advertising.

Usually, less than 1 dollar in 3 actually ends up going to education. Even if that’s still billions of dollars for schools, the numbers are deceiving. Legislatures will anticipate the lottery profits, by substituting the money for other traditional funding methods, instead of simply supplementing it as if the system was made for that purpose.

Investing is a much safer bet

In case you won $17,657 by playing the lottery, you would get super excited, right? But if you took the $220 that any average American adult spent on all the lottery tickets each year and invested it, after 30 years, you’d have $220 contributions, with a 6% return.

Yes, it might not be a $1 billion jackpot, but by relying on compound interest, not on luck, you would generate a respectable windfall!

If you enjoyed reading this article, we also recommend reading: 7 CONSUMER STOCKS THAT DO BEST DURING INFLATION