When was the last time you received a stimulus check?

Some experts say that we are victims of one of the highest inflations in our country’s history and all we can do is come up with a plan to reduce our spending. Some of them even say that we have to deal with the biggest prices we’ve seen in the last 4 decades, when in the 1980s, for instance, the inflation rate was 14.6%.

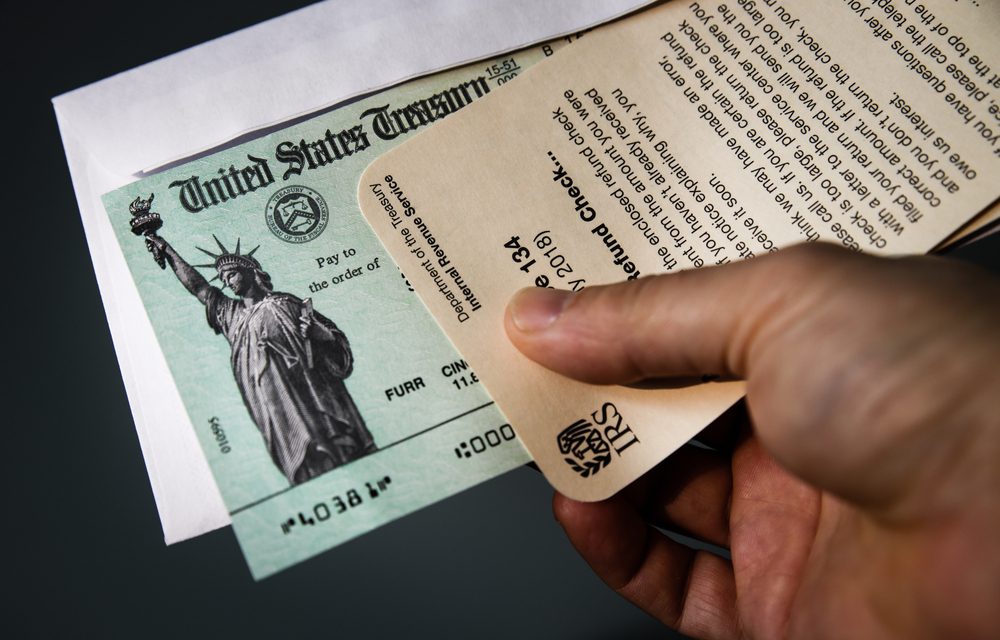

Speaking of that, the federal government is trying to help people counteract the record-high rate of inflation, so, as a result, 18 states are, or have, already begun issuing stimulus paychecks to their taxpayer residents.

Even though some of these compensations are for hundreds of dollars and others go up to a few thousand, they are not the most effective way to get rid of inflation.

In accordance with some senior international economists, plans that target specific groups or sectors, like gas cards or expenditures that are based on compensation thresholds, could help people with their spending and the higher prices for different products or services. This happens without adding a lot of pressure on prices more broadly.

With that being said, here is how 18 states have passed bills to begin distributing tax refunds to citizens. Let’s take a look at how these installments are progressing and what the stimulus checks are actually worth.

JUST WONDERED WHY “OKLAHOMA” IS OUT OF THE LOOP FOR A STEM CHECK?

IS CALIFORNIA ONE OF THE STATES AND IF SO, WHEN WILL THEY BE GOING OUT?????

I only received one stimulus Check when that started last year or before. My husband never recieved any. we are living only on our social security check each month, and out of that they take for Medicare, and when landing in the hospital, they are wanting more money because our insurance didn’t pay the entire bill or medicare either.

SOOooo which 18 states are they you dip of a media???? I dont see them mentioned other than “these eighteen states are issuing stimulus checks.”

are we getting one?

thanks