Do you know how to protect your wallet from inflation?

After the COVID-19 pandemic, it feels like everything changed, and from one day to another, prices are becoming, let’s put it mildly, horribly huge. The future doesn’t seem very bright, leaving us worried about emptying our credit cards and wallets in the blink of an eye.

While this is an aspect we can’t really change or control, some tips can help us manage our money and budget more effectively during these hard times of economic uncertainty. If you want to know how to protect your wallet from inflation, keep reading to see what steps you can take to protect your money from growing prices and to find out how to deal with situations when you’re already having trouble!

1. Always follow your monthly budget and don’t go overboard

One of the major changes you have to make to adapt to this economic crisis and protect your wallet from inflation is to establish a monthly budget and follow it accordingly.

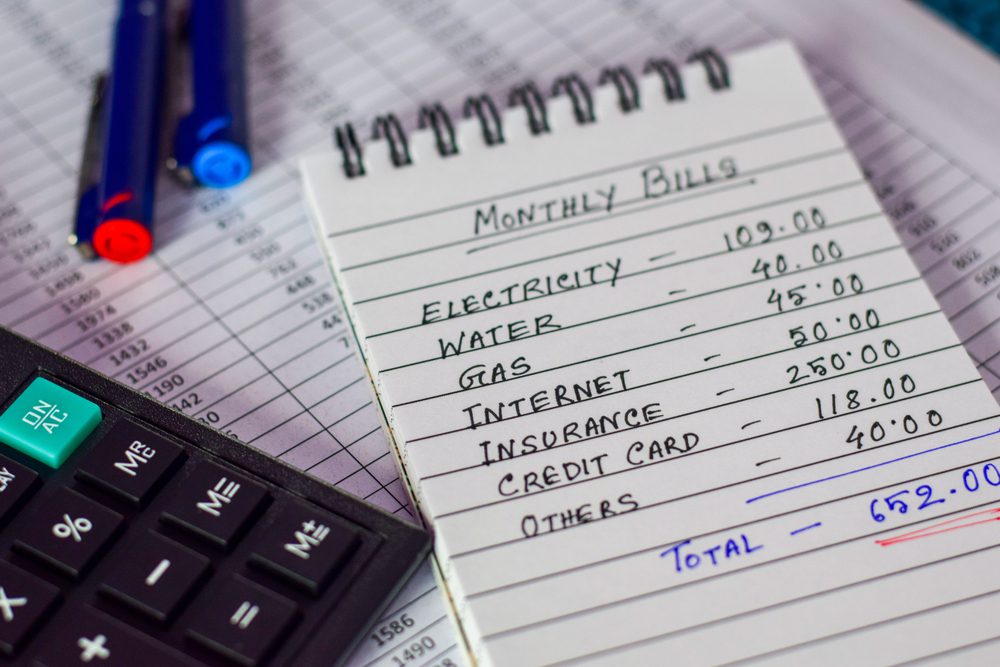

Add all of your fixed expenses, like rent, utilities, groceries, and monthly bills, to it. You should also factor in any variable expenditures that can arise from unforeseen spending or shifts in the market.

You may find opportunities to cut costs and keep up with financial management by routinely monitoring these expenses. By using this monthly budget technique, you may also make plans for future expenditures, minimizing the impact of inflationary pressures on your financial stability.

2. Eliminate excessive shopping

Inflation has been hard on everybody; that’s why we were somehow forced to make big or small changes in our shopping habits. If before you were willing to spend money on your weekly groceries plus a few more other “treats,” now it’s time to reassess this.

According to recent surveys, around 80% of Americans changed their spending habits and tried to adopt a more frugal way of living. Examine your monthly and weekly spending to see what you can go without. Maybe it’s that monthly subscription to a streaming service that you barely use, or maybe that cleaning service is way too expensive to keep weekly.

If you are still in the working field, consider meal-prepping. It can be as tasty as takeout but less expensive! Furthermore, don’t forget to monitor the electronic wallet as well if you want to protect your wallet from inflation. When something is routinely charged to your credit card each month, it’s easy to forget about it.

3. Change the way you do your grocery shopping

One of the best ways to protect your wallet from inflation is by changing the way you do your weekly shopping. You can do that by simply switching from buying brand-name products to generic ones that taste the same. You may save 20–25% on almost the same thing if you do this.

Consider buying the same products from the frozen foods section rather than fresh fruits, vegetables (especially if they’re not in their full-bloom season), and meats. This hack might save you up to 50% and be just as healthy, lasting longer.

4. Hunt for sales!

This hack goes hand in hand with the one from above, and if you want to protect your wallet from inflation, one thing is certain: you must become a sales shopper.

Of course, that doesn’t mean you have to suddenly turn into an extreme coupon collector, but it will help if you start paying more attention to sales and let them determine when and where you purchase.

If you have a favorite shopping store, keep an eye on their website for weekly discounts and such. Some stores have big promotions on Wednesdays, others on Sundays. It can also be helpful if you install their mobile apps to keep track of the price list much more easily!

5. Emergency funds are a must

Our grandparents had a healthy habit regarding their money: having a mandatory emergency fund somewhere in the house. So, if you can handle it, it’s a good idea to set aside some cash in an emergency fund. This will give you a safety net of money in case of unforeseen costs.

Because issues can emerge at any time and life is unpredictable, having money set aside for these eventualities can be quite helpful. Try to save little sums of money regularly; even a little sum saved each month may build up over time.

You never know when you need to go to the doctor or when you face an unexpected issue with pipes and leaks in the house. It’s better to be ready and think ahead.

…Looking for a way to stay motivated with your savings? Consider purchasing a cute emergency fund box! This Ceramic Savings Bank is available on Amazon for just $24.87.

6. Try to reduce the energy consumption as much as possible

Another great way to protect your wallet from inflation is to reduce the cost of your monthly bills as much as possible. One of the most expensive ones, after rent, is the energy bill.

We all know that maintaining a pleasant temperature, running the water, and lighting may get expensive. Simple changes to your home’s energy usage might result in a 25% reduction in your overall cost.

You can take short showers, wash some of your clothes in cold water, adjust leaky faucets and duct work, replace incandescent lightbulbs with LED lightbulbs, purchase energy-efficient appliances, fix drafty doors and windows, and adjust the thermostat.

It may seem like small changes, but at the end of each month, when the electricity bill comes, you will definitely see some changes.

7. Always think about long-term solutions

While you are actively trying to protect your wallet from inflation, it is crucial to also think about the future and the fact that this economic crisis won’t last forever (hopefully).

If you can, keep making contributions to your savings account and prepare for future (or soon-to-come) retirement. A higher return on investment may also be obtained by investing in mutual funds or equities.

The greatest strategy to guarantee financial security during times of inflation is to save and invest with a long-term perspective.

8. Skip borrowing money

Unless it’s absolutely necessary of course, you must stay away from borrowing money as much as possible! Since credit cards, loans, mortgages, home equity debt, and other financial obligations now carry higher interest rates than they did a few years ago, it is important to note that today’s higher rates also apply to these types of debt.

Whenever possible, try to pay with cash or find a substitute for whatever you wish to replace instead of taking out a loan.

9. If possible consider having a side hustle

This probably sounds familiar to you, but if the time or your condition allows you to get a side hustle, we encourage you to. You can work as a freelance online, pet sit, or teach a foreign language.

Having a side business is a fantastic way to supplement your income and also protect your wallet from inflation. Retirees looking to supplement their income in their later years may also engage in them.

If reading about how to protect your wallet from inflation was an interesting reading, and you want to read more from The Money Place here’s a fantastic post for you: 6 Costly Habits You Need To Quit Right Now!